Author: Sebastian Wittor Project Manager at BAYOOMED

When you think of health insurance companies, you often think of bureaucratic structures: paragraphs, administrative acts and rigid processes. However, these traditional images often conceal modern organizations with motivated teams that are open to innovation and actively work on new solutions.

The collaboration with various statutory health insurance companies clearly shows that partnerships that were originally technically oriented can quickly develop into genuine joint development projects with shared goals. Surprising insights and opportunities arise, particularly in the implementation of AI projects.

Unused potential in proven structures

The data situation in health insurance companies is more impressive than one would expect. Of course, we know that a lot of information is collected there. But how structured and at the same time underused much of this data is is a constant surprise.

It is particularly striking that the processes used on a daily basis work surprisingly well despite their complexity. However, they often no longer correspond to the current state of technical possibilities. Many processes have grown historically and have remained stable over the years without having undergone any major adjustments. This is precisely where there is considerable potential.

The openness towards new approaches is remarkably positive. There is a willingness to change, especially in the specialist departments, which feel the pressure of new requirements on a daily basis. Successful projects are created when not only tools are delivered, but when change is shaped together.

Concrete implementations: From knowledge to quality assurance

The work with various health insurance companies covers several areas, each with its own dynamics, but all with the same goal: to simplify processes, make better use of knowledge and support employees.

Internal knowledge management

The classic problem of large organizations: Information is available but difficult to find. The generative AI approach, which is based on internal knowledge sources, helps employees to retrieve information quickly, provides formulation aids for complex feedback and significantly reduces the time required for recurring searches. This not only saves time, but also creates more certainty in communication on challenging topics.

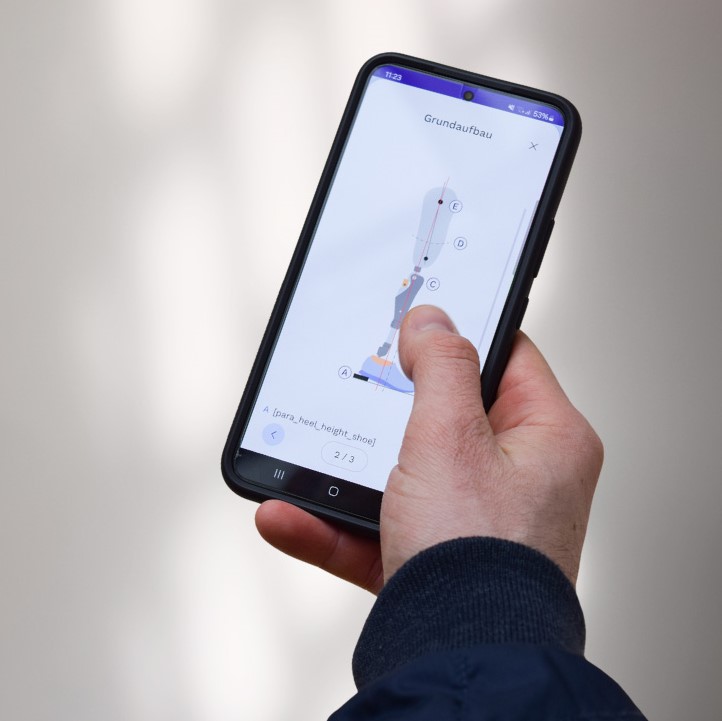

Intelligent process support

This is less about complete automation and more about smart preparatory work. AI can make preliminary decisions, initiate checks and organize processing steps more intelligently. The necessary data is available, it just needs to be used systematically. This implementation takes place step by step in close cooperation with the respective specialist departments.

Anomaly detection for services

Quality assurance and fraud prevention benefit considerably from AI-supported analysis. Anomalies can be identified more quickly and checked in a more targeted manner. This is not about blanket assessments, but about better indications that support human decisions. This allows resources to be used more efficiently without compromising trust in the processes.

Policyholder management

There are also interesting opportunities in direct contact with policyholders, from a better understanding of their concerns to faster responses and systematic feedback analysis. AI makes it possible to respond more individually and work more efficiently at the same time.

The strategic aspects are particularly exciting: How are the needs of the insured developing? What makes a health insurance company really attractive? These insights are often already contained in existing data and only need to be made visible and analyzed intelligently.

Findings and outlook

After several successful projects in different areas, it is clear that health insurance companies have a valuable database that can have a considerable impact if used correctly. However, this does not mean that everything works immediately and fully automatically. Successful implementation requires time, an understanding of established structures and, above all, trust between all those involved.

Working together as partners at eye level is proving to be a decisive success factor. When both sides are open and learn from each other, technical solutions result in real improvements in everyday working life. These effects are not only perceived by the employees, but ultimately also by the insured persons.

With large numbers of insured persons, even small optimizations can have a noticeable impact. The decisive factor is the joint approach and the gradual exploitation of existing potential. The combination of technical expertise and a methodical approach on the one hand and professional competence and practical experience on the other makes successful projects possible.